Supply chain disruption and Omicron variant to slow recovery in UK; German Factory Orders Collapse – Business Live | Business

[ad_1]

Hello and welcome to our continued coverage of the global economy, financial markets, euro area and business.

The UK’s economic outlook looks less bright this morning as shortages, rising costs and the possibility of more Covid restrictions all threaten growth.

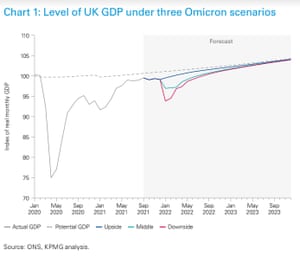

KPMG warned that GDP growth could be cut by more than half next year if more restrictions are introduced to tackle Omicron, depending on the severity of the new variant.

In its central scenario, the UK government would reinstate social distancing restrictions in retail and hospitality locations, and encourage people to work from home if they can in January and February 2022.

If that happened, the economy is expected to contract by around 2% in the first quarter of 2022, slowing overall growth next year to 2.6%, from 6.7% this year.

In KPMG’s downside scenario, the threat of a significant increase in acute Covid-19 cases triggers another lockdown in early 2022. That would trigger a sharp drop in GDP, of around 4.2%, in January -March 2022, reducing growth next year to just 1.8%.

While the growth momentum is expected to slow until a booster is deployed to stop the increase in cases, the full impact of the new variant will depend on the increase in the number of acute cases of Covid and any restrictions in social distancing introduced, he explains. .

Yael Selfin, chief economist at KPMG United Kingdom, says:

“The Omicron variant has raised the level of uncertainty on the path to recovery from the pandemic.

While the impact is not expected to be as severe as it was at the start of the pandemic, or even early this year, increased uncertainty and the potential reintroduction of social distancing measures could see production plummet this month and into the future. during the first quarter of 2022. “

Some sectors may remain significantly affected by the pandemic, relative to the overall economy, the report adds:

Additional travel restrictions and new pandemic hot spots are expected to lead to a slower and more prolonged recovery in the industry. Train travel will also be affected by a slower return of commuters to their workplace.

Commuter ridership was still 22% down at the end of November from pre-pandemic levels and is likely to decline as people are encouraged to work from home.

KPMG also warns that supply chains would come under more pressure if the pandemic again resulted in increased demand for goods from stranded consumers. Labor shortages have become a major obstacle to growth, he adds, while pushing up wages.

These concerns could deter the Bank of England from raising interest rates at its next monetary policy meeting later this month. Deputy Governor Sir Ben Broadbent gives his perspective on the economic outlook this morning.

We also find out how UK and Eurozone automakers fared last month.

Agenda

- 7am GMT: German factory orders for October

- 8:30 am GMT: Euro zone construction PMI for November

- 8:30 am GMT: UK construction PMI for November

- 11:30 am: Bank of England Deputy Governor Sir Ben Broadbent delivers a speech at Leeds University on “Growth, Inflation and Monetary Policy Outlook”

[ad_2]

Comments are closed.